News Postings

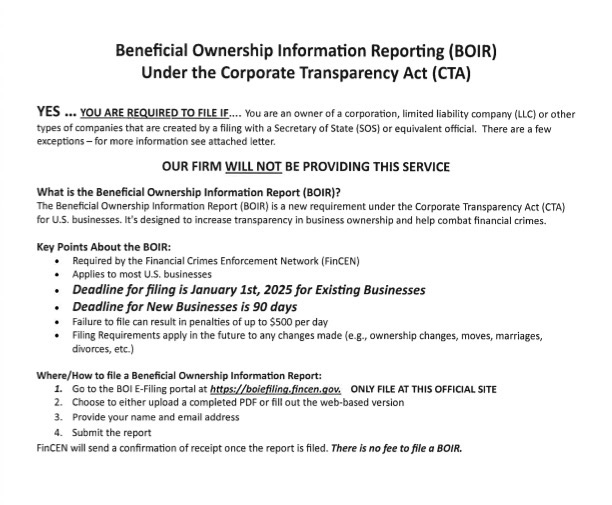

ALERT: Beneficial Ownership Information Reporting (BOIR)

Our firm is sending this communication to provide you with an update of the latest regulatory development from FinCEN regarding the beneficial ownership information (BOI) reporting requirements under the Corporate Transparency Act (CTA).

Overview of Latest Developments

The Financial Crimes Enforcement Network (FinCEN) published an interim final rule (“Rule”) in the Federal Register on March 26, 2025 (Federal Register :: Beneficial Ownership Information Reporting Requirement Revision and Deadline Extension), that removes the requirement for U.S. companies and U.S. persons to report beneficial ownership information (BOI) to FinCEN under the Corporate Transparency Act (CTA).

The Rule revises the regulatory definition of “reporting company” to mean only those entities that are formed under the law of a foreign country and that have registered to do business in any U.S. State or Tribal jurisdiction by the filing of a document with a secretary of state or similar office.

In addition, the Rule exempts foreign reporting companies from having to report the BOI of any U.S. persons who are beneficial owners of the foreign reporting company and exempts U.S. persons from having to provide such information to any foreign reporting company for which they are a beneficial owner.

As always, contact us if you have any questions.

Standard Occupational Codes (SOC) - ONET

Starting first quarter of 2024, penalties will be imposed. Please use the link provided to find the code that pertains to your specific occupation.